The Bubble and the Boom

FOR PAID SUBSCRIBERS: AI is both a speculative surge and a brutally real transition. Which will be the story that sticks?

Some readers might be surprised to learn that my Columbia University master’s degree is not from its well-known school of journalism but rather from the school of engineering, where I studied computer science and, absurdly enough, artificial intelligence. I even put in some PhD time before giving up the ghost and moving to journalism. Since all that was decades ago, anything I know from that period is vastly outdated. But I’ve kept an eye on the field and wandered back into its neighborhood here and there, working with various startups. So I follow the AI revolution with no little fascination. And just a bit of trepidation.

Join our community! To support the defense of democracy and reason, unlock full access to Ask Questions Later by upgrading to a Paid Subscription (unless you have one)

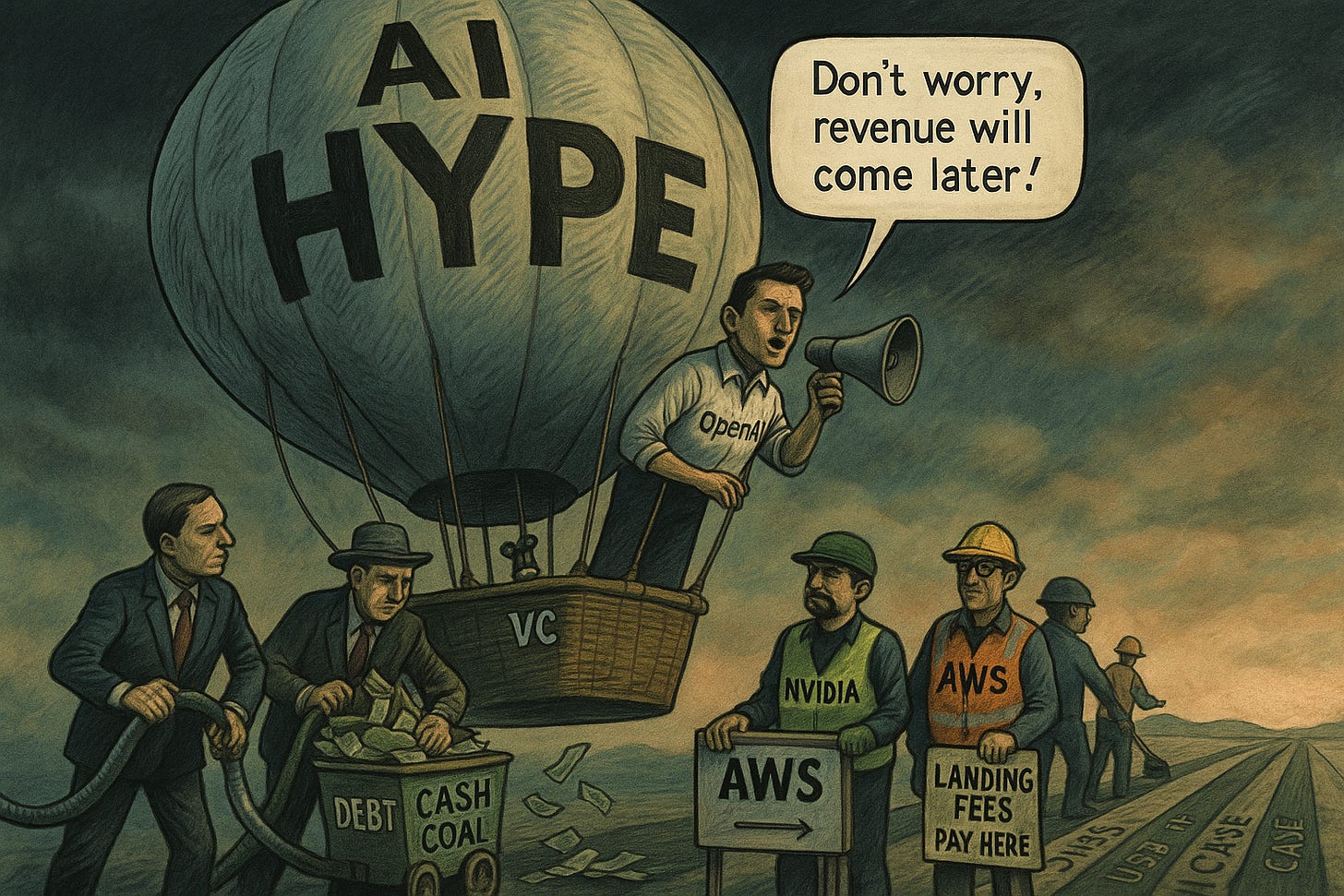

And one key question for anyone with savings in the stock market is whether we’re in a bubble. Historically, market bubbles have three ingredients. First, excessive optimism about future cash flows: investors convince themselves that some new technology will justify almost any price. Second, easy money: large flows of capital, perhaps cheap debt or exuberant schemes, pour in. Third is wishful thinking: Weak economics for a big chunk of the players, with companies losing oceans of money in ways that don’t look fixable — yet people refuse to see it. That, roughly, was the dot-com boom and bust of a quarter century ago. All these ingredients now exist, but they are not uniformly distributed. Some companies really seem set to take over the world. There is no consensus.

And there is also a massive question hovering over everything: No one knows what the revenue side will look like. Right now the services are cheap or even free because everyone is racing for market share. That seems like it cannot last. Maybe the prices will fall as the technology improves — or maybe they will rise sharply once a few dominant systems are in place. We simply don’t know.

Moreover, it is entirely possible that OpenAI, Google’s Gemini, Musk’s xAI and a couple of others end up as a sort of club — not formally colluding, but each quite aware that higher prices help everyone. If that happens, the financial picture flips: what looks shaky today might suddenly look like a license to print money. But on the other hand, China’s DeepSeek may actually stay free forever and be as good or better than the above others and totally distort the market. No one knows!

Still, consider this: If it turned out that to use any of the models comfortably, without running into limits and slowness, you needed to pay not $20/month but $200, and there was no way around it (sharing would be banned and policed!) – would you agree? And if the AI firms tried this, would and could it be regulated?

Meanwhile, there are consequences beyond these companies and the markets. Last month we examined AI luminary Geoffrey Hinton’s warning that these huge investments only make sense was if companies are preparing mass firings. Today we take a deeper look at the numbers and what companies are actually doing.